If you have income that is not tax-exempt, you may have to pay income taxes in retirement. In this case, your gross income will equal zero, and you won't have to file a federal income tax return. If during retirement you only have income from Social Security benefits, then you will not include those benefits in your gross income. If you worked for an employer or had net profits from self-employment before retirement, you'll receive Social Security benefits in retirement. Pay attention to Social Security and other income amounts Here are seven tips to help you restructure your payment strategies to optimize your tax results in the areas of Social Security, 401(k)s, and IRAs. But you should also have an understanding of how your taxes in retirement will affect your savings and your future income.

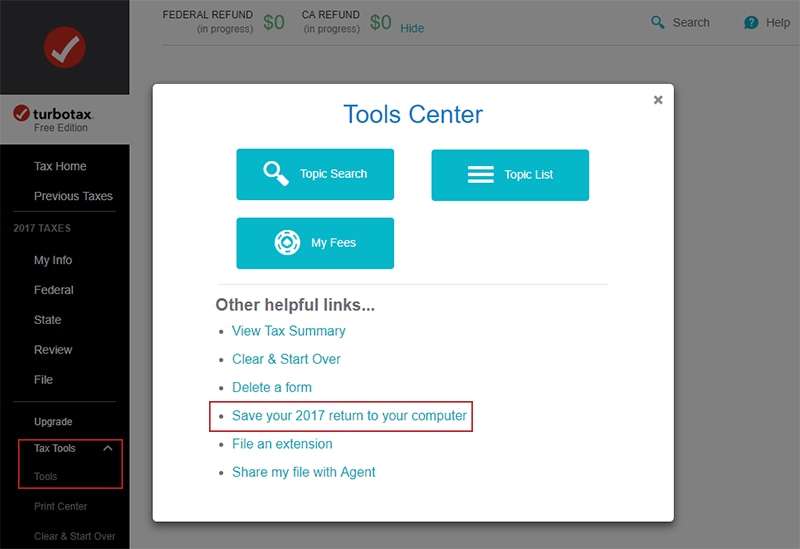

DOES TURBOTAX HELP WITH QUARTERLY TAXES FREE

Tax Calculator – Return & Refund Estimator 2022-2023 …Įstimate your tax return or how much you owe the IRS with our free TaxCaster tax calculator that stays up to date with the latest tax laws so you can be confident in your calculations.When you start putting money away for retirement, you might be thinking of the tax benefits or consequences you'll incur. Tax Calculator Advertiser's Disclosure 2022-2023 Tax Refunds and Estimators Estimate how much you will have to pay in federal taxes for the 2022 tax year using your income deductions and credits - all… Tax Calculator 2022-2023 Return Estimator and Refund … That breaks down to 12.4% Social Security tax and 2.9% Medicare tax. For example in the 2022 tax year the self-employment tax rate on net income up to $147000 is 15.3%. Self-employment tax (Social Security and Medicare) Income tax on the profits your business generates and other income. Guide to Paying Quarterly Taxes – TurboTax Tax Tips & Videos In general, you should make an estimated tax payment if you expect to owe at least $500 ($250 if married/filing RDP separately) in taxes for 2023 (net of deductions and credits) and you expect your deductions and credit to be less than the less of 90% of the tax shown on your 2023 tax return or Non-withholding taxpayers such as those who are self-employed investors or retirees may need to make quarterly tax payments.Ģ023 Instructions for Form 540-ES | FTB.ca.gov WASHINGTON - The Internal Revenue Service reminded taxpayers paying estimated taxes that the deadline to submit their third quarter payment is September 15, 2022. IRS September 15 is the deadline for third quarter tax estimates…

DOES TURBOTAX HELP WITH QUARTERLY TAXES PLUS

There are several ways to pay an estimated…Įstimated Tax Payments How They Work When to Pay in 2023Įstimating Tax Payments How It Works When to Pay in 2023 Learn how and when to pay estimated taxes - plus find out if you should worry about it in the first place. Use Form 1040-ES to pay your estimated taxes. IRS Estimated Due Date Tax Payment for 2023 | Kiplinger The Jpayment covers the period from April 1 to May 31, 2023. The Appayment is for taxes due January 1 to March 31, 2023. June 15th is next week which means if you don't have taxes taken…Įstimated Tax Payment Due June 15 IRS Says Estimated quarterly tax payments are due again in mid-June. Business tax?Įstimated quarterly tax payments are due again in mid-June… If you make more than one type of payment or make payments for more than one tax year, submit each separately. Information about payment types can be found by clicking on the help icon ( ?).

Step 1 of 5 Tax Information Select the appropriate payment type and your reason for payment. You can also make estimated tax payments through an online account where you can view payment history and other tax records. You can submit estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

1.9 Guide to Paying Quarterly Taxes – TurboTax Tax Tips & Videos.1.8 2023 Instructions for Form 540-ES | FTB.ca.gov.1.7 IRS September 15 is the deadline for third quarter tax estimates….1.6 Estimated Tax Payments How They Work When to Pay in 2023.1.5 IRS Estimated Due Date Tax Payment for 2023 | Kiplinger.1.4 Estimated Tax Payment Due June 15 IRS Says.1.3 Estimated quarterly tax payments are due again in mid-June….1.1 Estimated Tax | Internal Revenue Service.

0 kommentar(er)

0 kommentar(er)